Objectives

- Manage expenses

Environment

- Money Module

Additional Information

...

...

Procedure

...

Steps

From the Billing Module, you can manage expenses which can be court

...

fees, expert

...

fees, translation, and so on. You can record new expense by clicking on the expenses in the main menu, a drop-down list will appear, click on record expense.

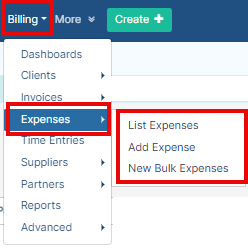

To Access it, you can directly click on Billing→ Expenses, and choose the option you need.

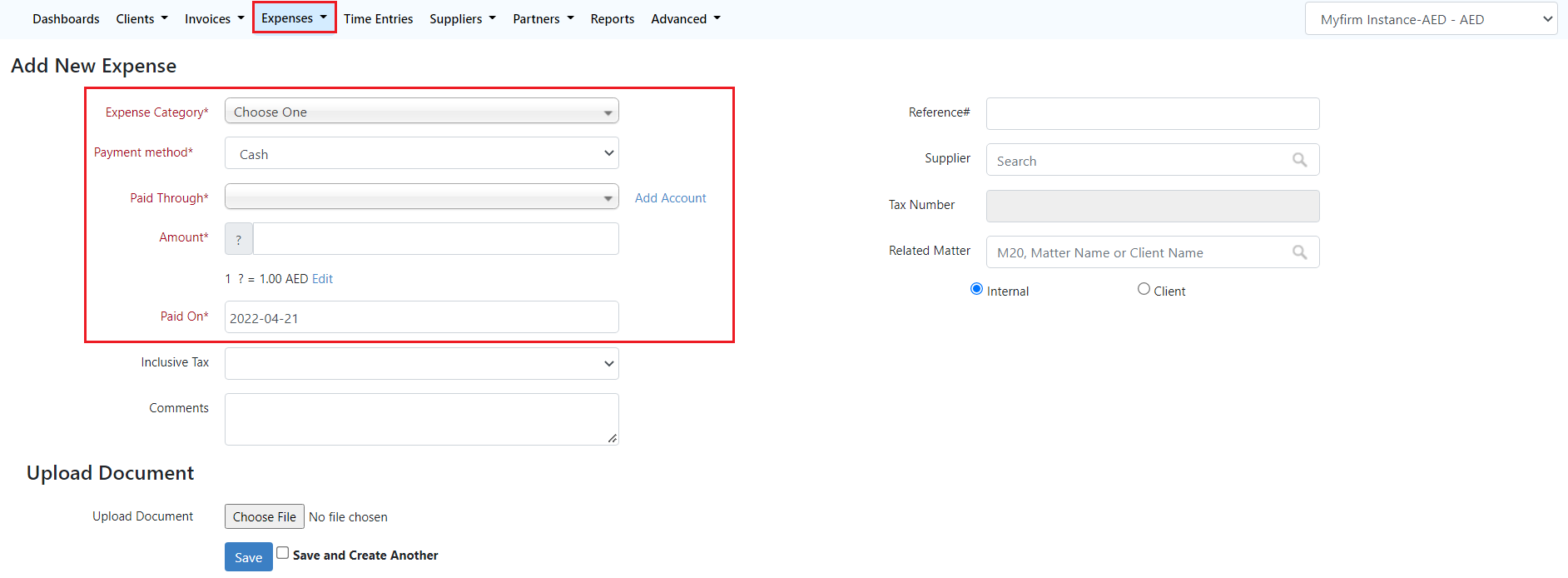

To record a new expense click on Expenses → Add Expense.

| Anchor | ||||

|---|---|---|---|---|

|

| Info |

|---|

You can also record |

...

expenses from the |

...

Tools button |

...

in the expenses |

...

grid or from the |

...

quick New button in the main menu. |

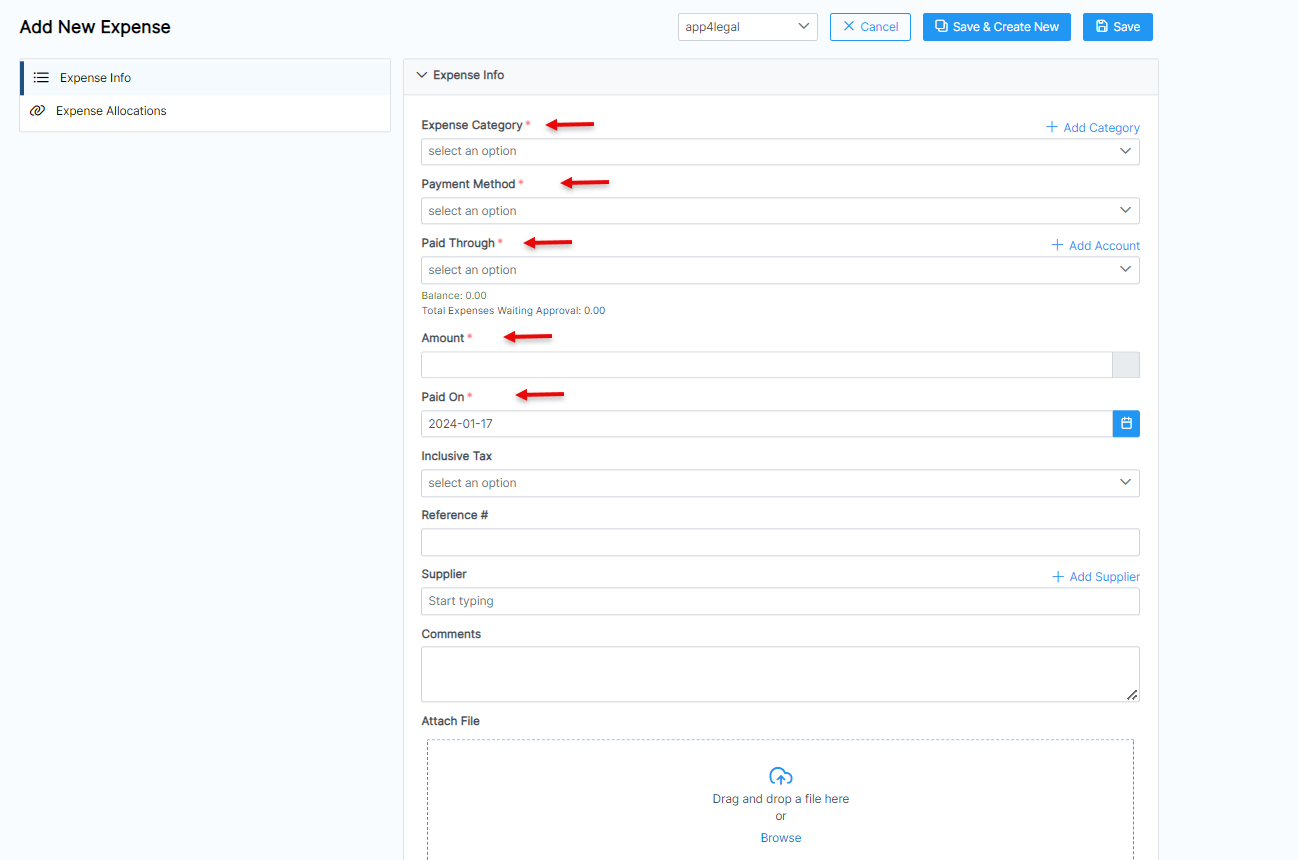

Fill out the mandatory fields:

...

There are 5 mandatory fields: Expense category, payment method, paid through, amount and paid on.

- Expense Category: Categories are defaulted default in the Money Billing Settings.

- Payment Method: The method determines the types of accounts that appear accordingly:

- Cash: Cash Accounts

- Credit Card: Liability of type Credit Card Accounts

- Cheque & Bank: Bank Accounts

- Online payment: Bank Accounts and Credit Card Accounts

- Other: Cash, Bank, and Credit Card AccountsCard Accounts

- Paid Through Account: The Account that appears as per the Payment Method. Accounts can be added on the fly via the Add account hyperlink. The Add account form will provide users the possibility to add Accounts of type Cash, Bank and Credit Card using this link.

- Amount

- Balance: After choosing the Paid Through Account, the system will automatically display the Balance of the Account for information.

- Exchange Rate: Exchange Rates will be used only in case the Paid Through Account's currency is different than that of the Entity.

- Paid On: date

- Inclusive Tax

- Comments

- Reference#

- Supplier: Looks up from the list of Suppliers

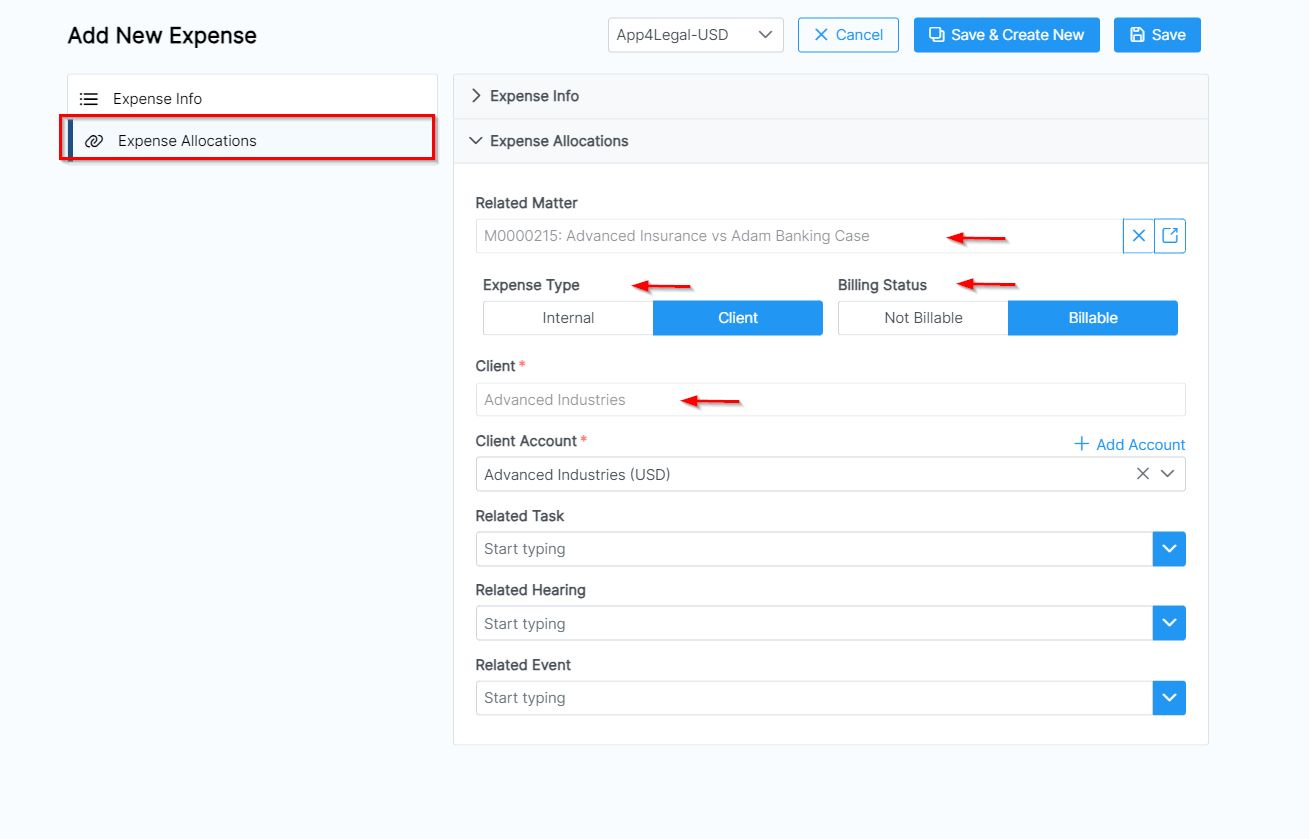

- Related Matter: If Expenses Are Recorded directly from the Related Expenses tab in a matter form, then the matter comes selected by default.

- You can choose if Internal or Client. When the Client is chosen, it could then be either Billable or Non-Billable

- Upload Document: Any attachment related to the Expense such as vouchers or similar. The Attachment can then be tracked in the Related Documents tab of the Expense.

- Paid On: date of the expense payment.

Additional information could be the Tax, Reference number, supplier, comments, or any related documents that could be attached as well.

Expenses could be related to matters, contracts, tasks, or hearings. Therefore you can specify this while adding the expense from the Expense Allocation Tab.

Expenses could also be Internal or Client-related. In the case of Client-related Expenses, you have to specify if it will be billable or not and add the client account accordingly.

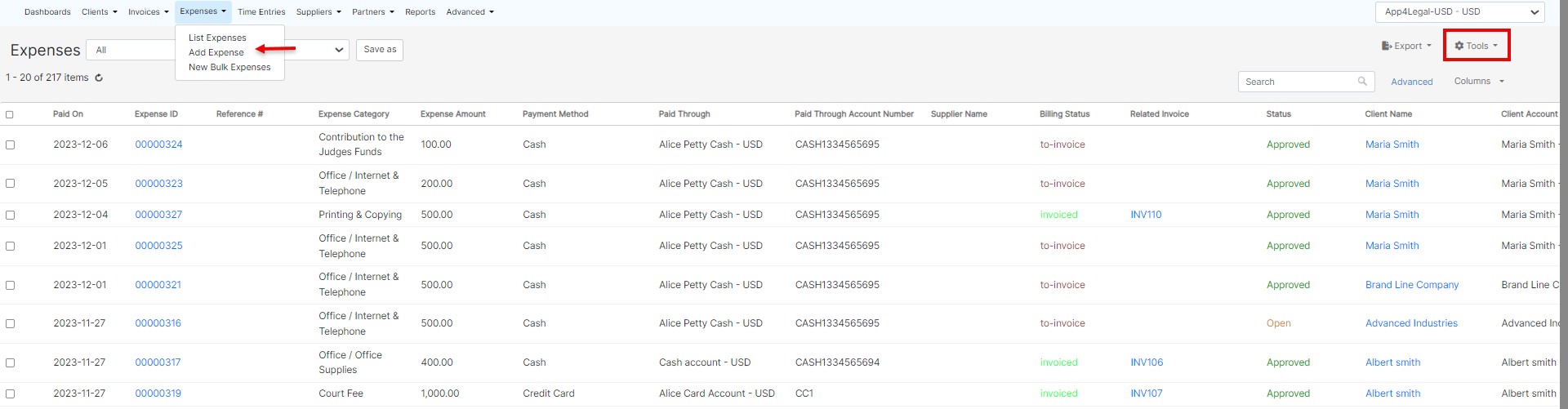

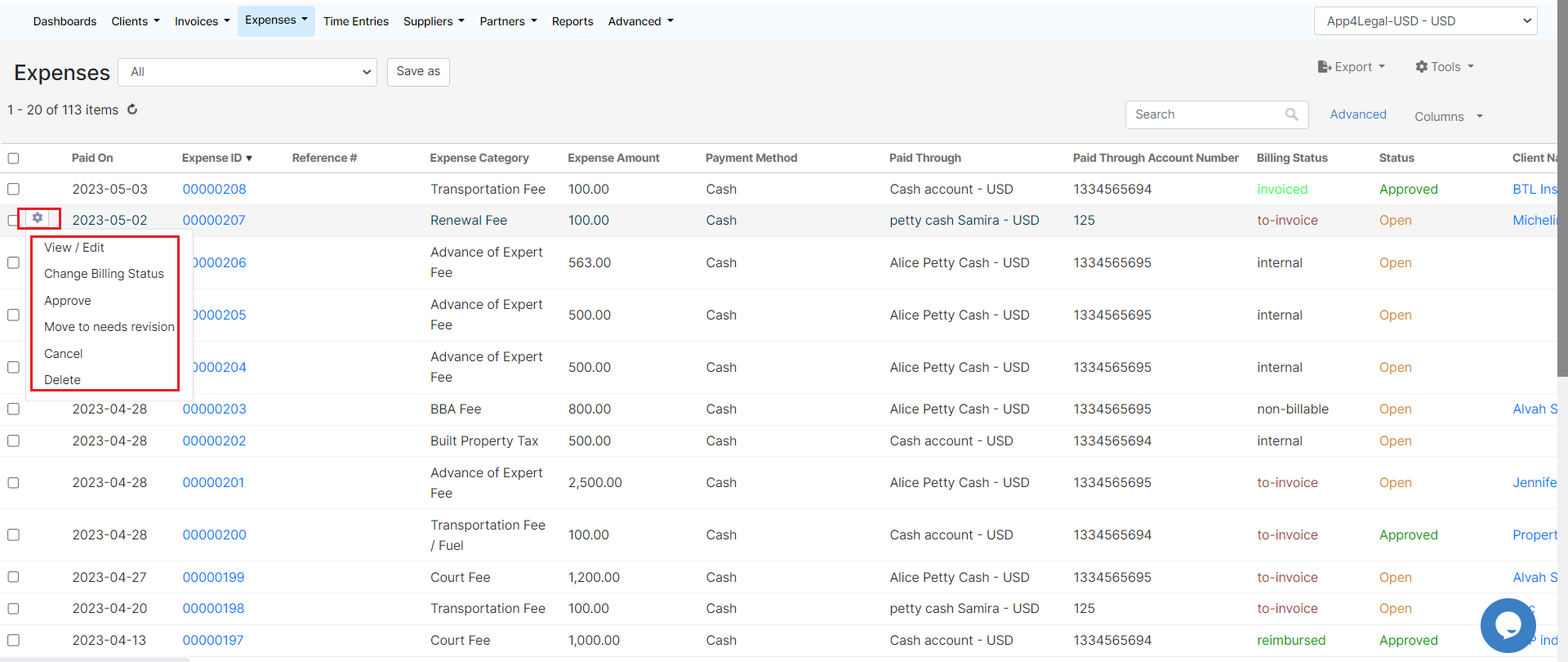

All the expenses will be then listed in the Expense Grid, simply access it from Billing→ Expenses→ List Expenses from the navigation menu.

The expenses grid is where you can track and manage all the Expenses recorded, Advance your search, get reports, add bulk expenses, and so on.

| Anchor | ||||

|---|---|---|---|---|

|

All the expenses added can be viewed in the list along with their details, such as amount, status, related client account, and so on.

There are certain actions a user can do from the settings wheel next to an expense (view/edit, change billing status, etc.).

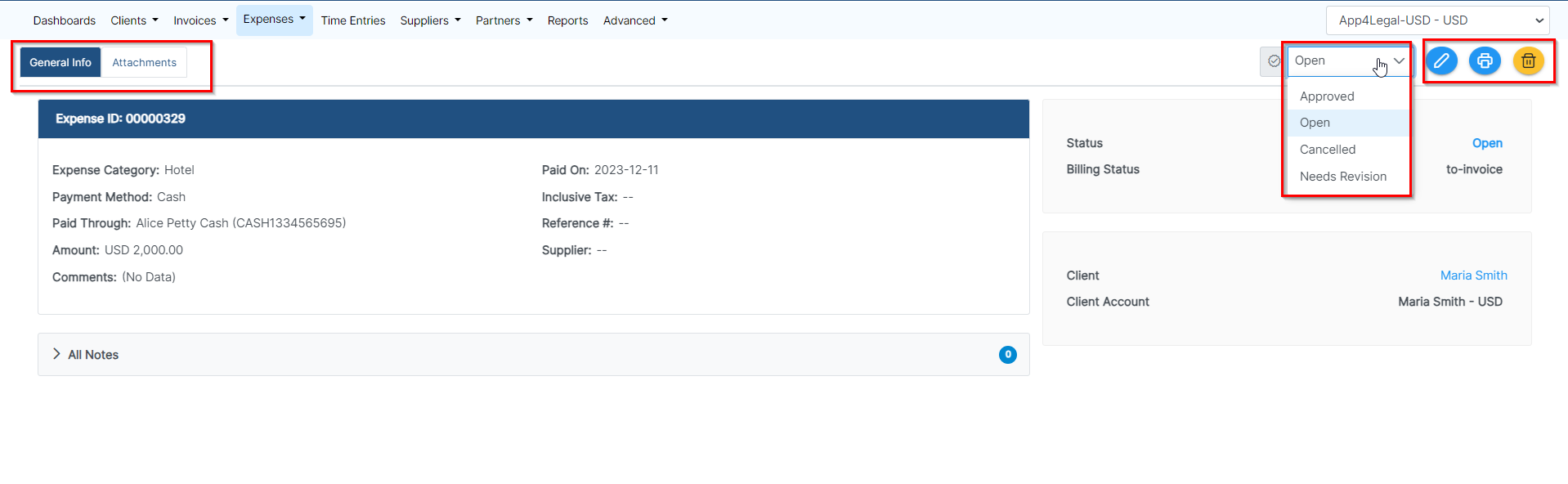

The admin can set an approval process where the user that is responsible for the Money module (ex. accountant) will have to approve recorded expenses before generating an invoice.

In this case, the expense is not yet approved and is still in open, so the user responsible will need to approve it in order to move through the expense workflow. When the expense is approved, the user responsible will have the option to set it as “needs revision”.

...

. Therefore, responsible users such as accountants, can edit the expense information, approve, review, or cancel an expense before being invoiced.

| Warning |

|---|

Invoiced and Reimbursed expenses can not be edited or deleted. |

| Info |

|---|

Reimbursed Expenses are expenses that are invoiced and the related invoice has been paid |

For more information about LEXZUR, kindly reach out to us at help@lexzur.com.

Thank you!