Objectives

- Add Log time to a Corporate Matter/Litigation Case

- Record expenses related to a Corporate Matter/ Litigation Case

Steps

In App4Legal, you can record Time logs and Expenses to a Corporate Matter and to a Litigation Case. Additionally, there is a Time Tracking module.

The Time Tracking module In App4Legal enables you to track your time manually by adding your time logs, or automatically by using the timer embedded inside

...

First, you can log time from the quick New button in the main menu then choose "Time entry".

...

the system.

To do that, simply open the matter, click on the Time Entries tab, click on the Actions

...

button, then choose "Time entry"

...

...

,

...

to record the

...

time spent on a

...

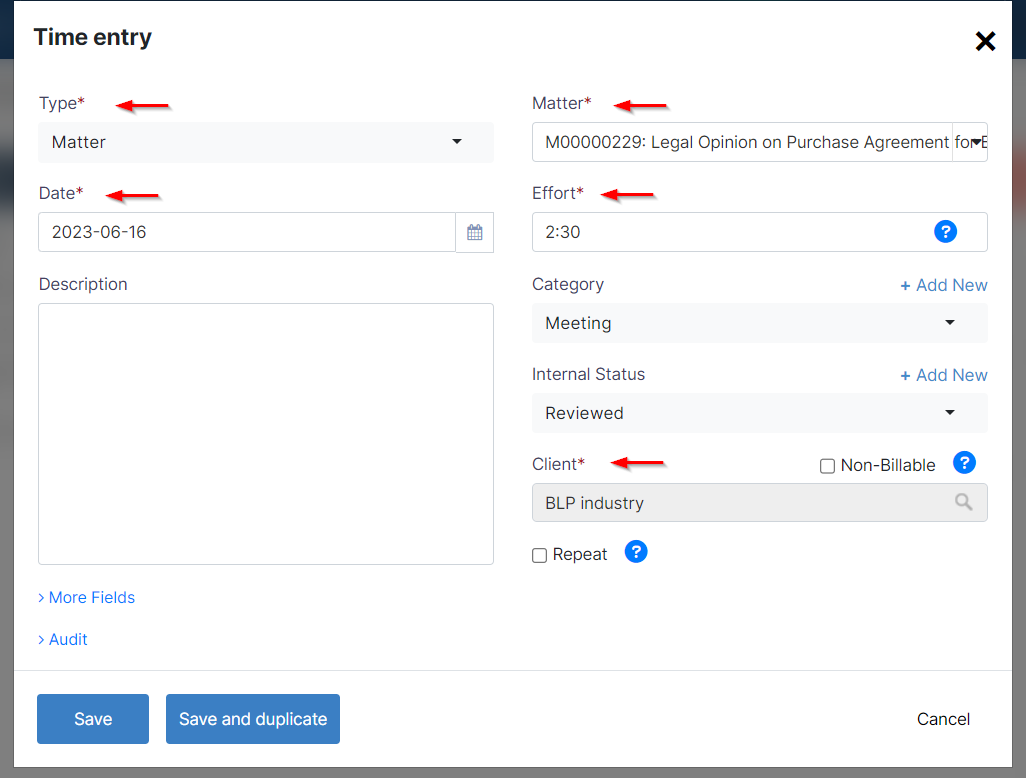

There are 5 mandatory fields: Type, Matter/Task, Date, Effort and client.

- Type: The Matter or Task to which the time is logged

- Matter/ Task: Depending on the type, either enter matter details (ID, name, and client name), or enter the Task at hand.

- Effort: Time logged in hours. When using "Manage Timer", the system will automatically calculate the Time in hours.

- Client: The Name of the client, which could be a company or a contact.

- If "Non- Billable" is chosen: the time log is non-billable

particular activity.

Adding time entries from the matter's page automatically sets some values, such as Type and the Matter name.

Likewise, the current date is set. However, you may choose another date and indicate the Effort logged in hours.

The Client Name is automatically retrieved from the related matter's information as well.

Time log entries are billable by default unless you check the non-billable box.

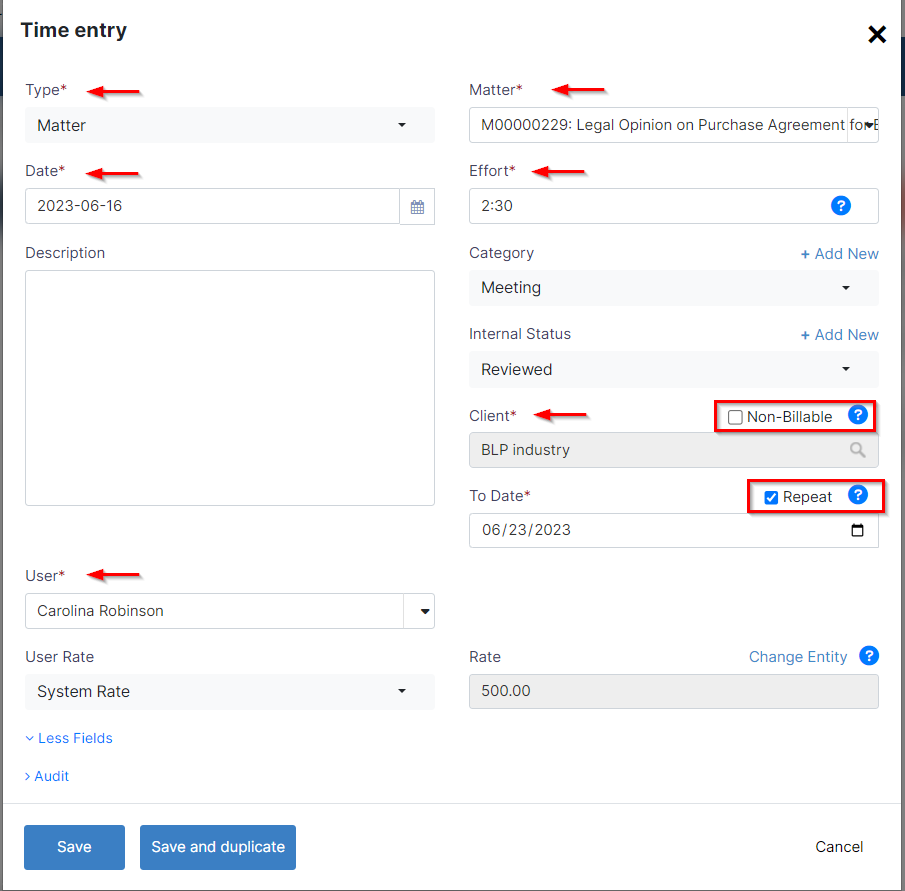

Additionally, admins can choose the user related to such time entry and the user rate. Therefore, they can choose between either the system's predefined rate or a fixed rate.

Time Logs could also be repeated on a daily basis. Check the Repeat option and set the To Date.

| Note |

|---|

Weekend days and holidays will not be included in the repeated time logs. |

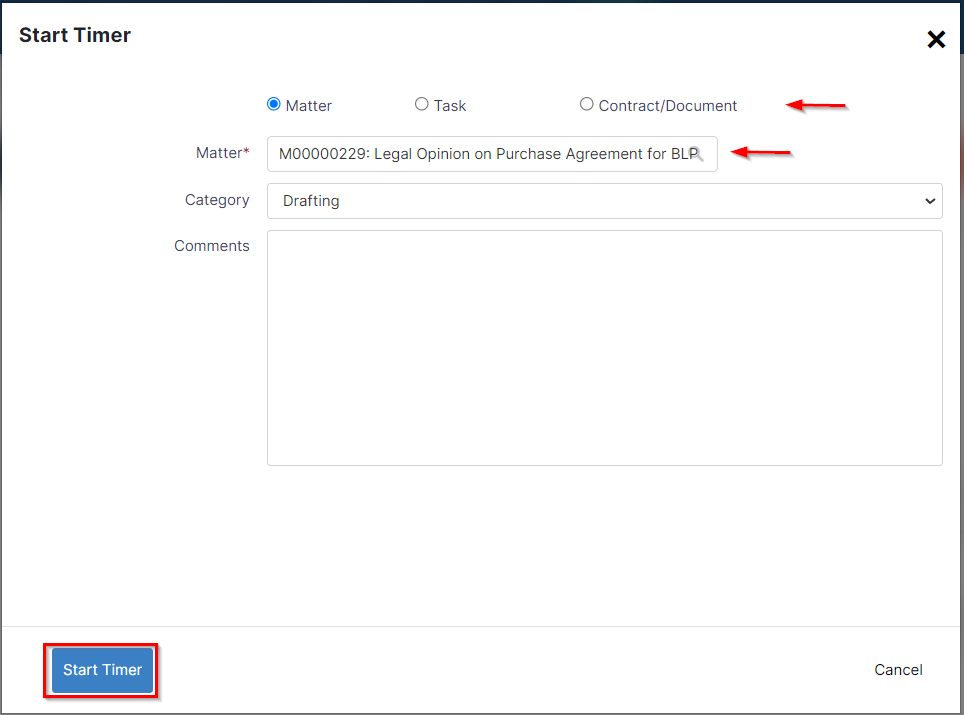

Furthermore, you You can also log time automatically by enabling starting the timer embedded inside App4Legalthe system.

Click on the timer available in within the main navigation menu → Start Timer.

Choose

...

the Type and specify the matter name, choose a category, and add comments if needed.

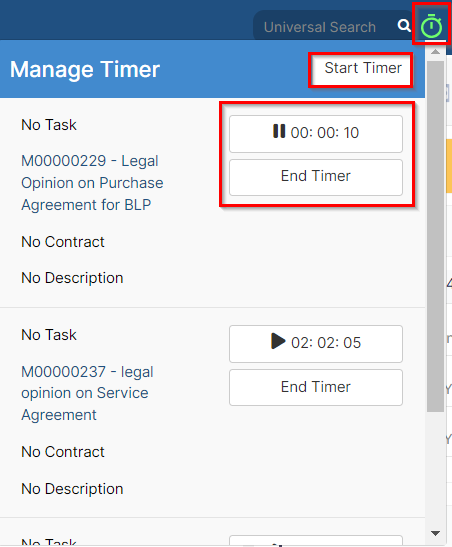

Upon finishing, you will have the option to pause or end

...

the timer, and the system will automatically calculate and log the time

...

to

...

the related matter.

To end the timer, click on "End Timer." Specify the client name and indicate whether it is billable or an internal time log. Finally, select the option to end the timer.

You can also record a New Expense to a Corporate Matter or a Litigation Case. You can do that from the quick New button and then select "Expense."

You can also do so by simply clicking on the ID or Name of the Litigation Case or Corporate Matter.

Then, go to the Expenses tab, click on the Actions button, and click on "Record Expense".

There are 5 mandatory fields: Expense Category, Payment Method, Paid Through, Amount and Paid On.

- Expense Category: Categories are defaulted in the Money Settings.

- Payment Method: The method determines the types of accounts that appear accordingly:

Cash: Cash Accounts

Credit Card: Liability of type Credit Card Accounts

Cheques & Bank: Bank Accounts

Online payment: Bank Accounts and Credit Card Accounts

Other: Cash, Bank and Credit Card Accounts

- Paid Through Account: The Account that appears as per the Payment Method. Accounts can be added on the fly via the "Add Account" hyperlink.

The "Add Account" form will provide users with the possibility to add Accounts of different types, such as; Cash, Bank and Credit Card using this link. - Amount: The sum to be paid

- Paid On: The date by which the payment should be received.

Once you record all the expenses related to a Corporate Matter or a Litigation Case, you can preview them in the grid.

Also, you have the option to export them into a spreadsheet for other reporting purposes.

For more information about App4Legal, kindly reach out to us at help@app4legal.com.

...