...

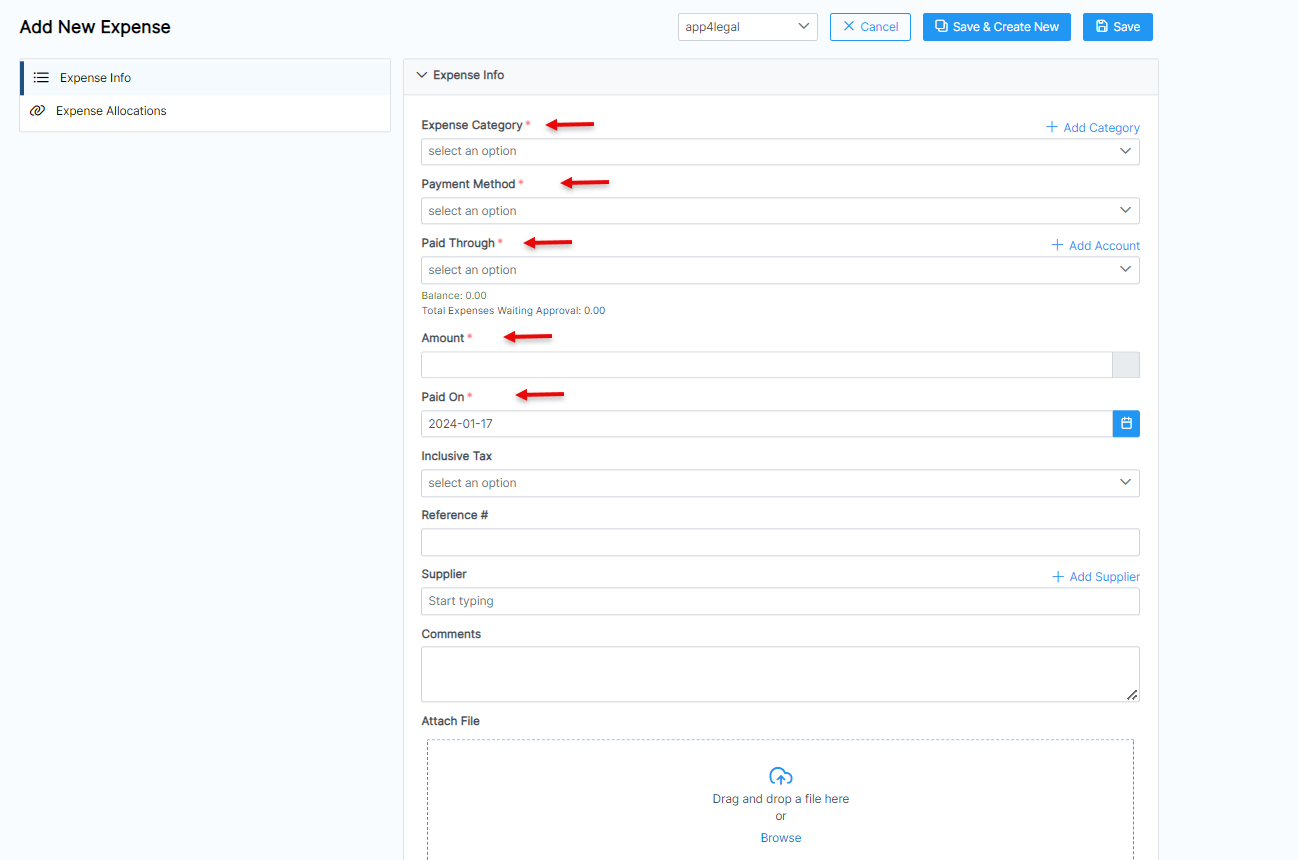

- Expense Category: Categories default in the Billing Settings.

- Payment Method: The method determines the types of accounts that appear accordingly:

- Cash: Cash Accounts

- Credit Card: Liability of type Credit Card Accounts

- Cheque & Bank: Bank Accounts

- Online payment: Bank Accounts and Credit Card Accounts

- Other: Cash, Bank, and Credit Card AccountsCard Accounts

- Paid Through Account: The Account that appears as per the Payment Method. Accounts can be added on the fly via the Add account hyperlink.

- Amount

- Paid On: date of the expense payment.

Additional information could be the Tax, Reference number, supplier, comments, or any related documents that could be attached as well.

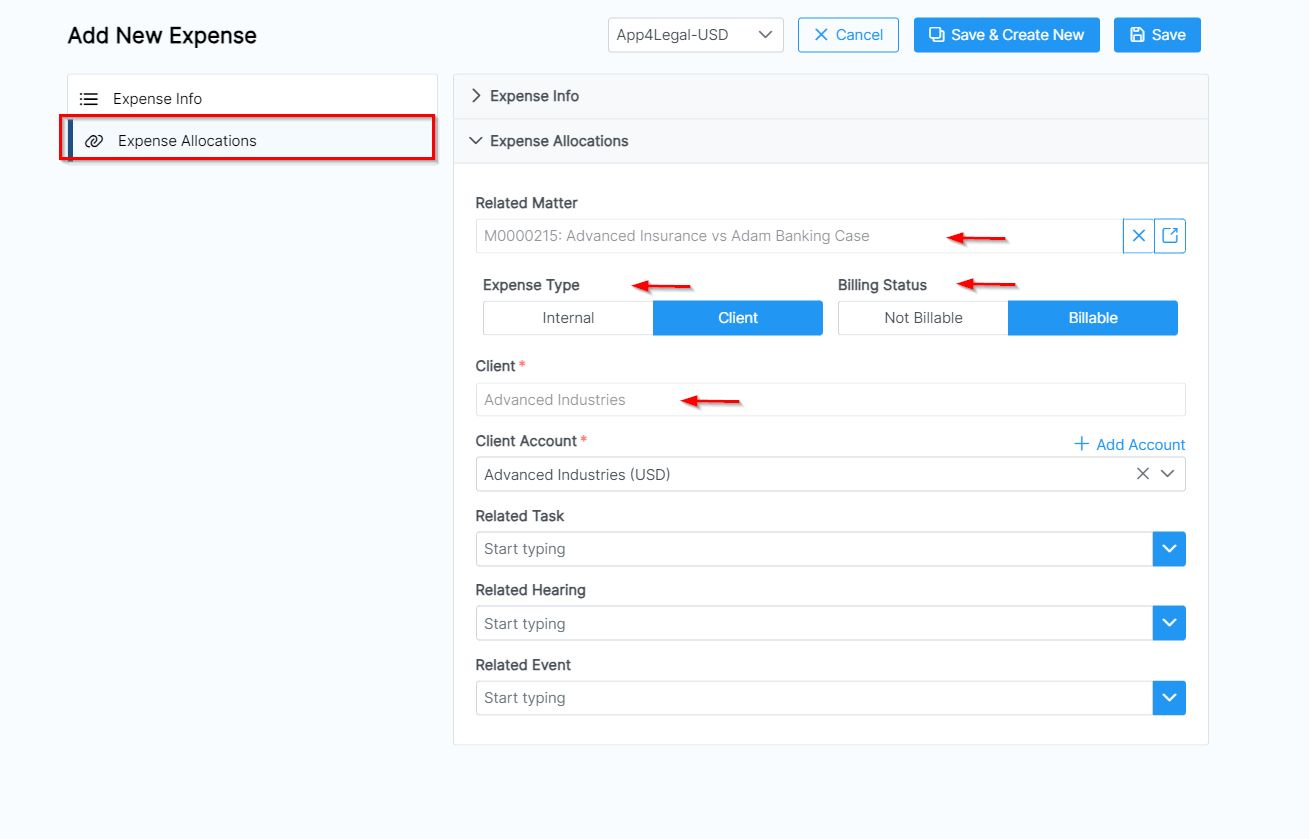

Expenses could be related to matters, contracts, tasks, or hearings. Therefore you can specify this while adding the expense from the Expense Allocation Tab.

Expenses could also be Internal or Client Related-related. In the case of Client Related -related Expenses, you have to specify if it will be billable or not and add the client account accordingly.

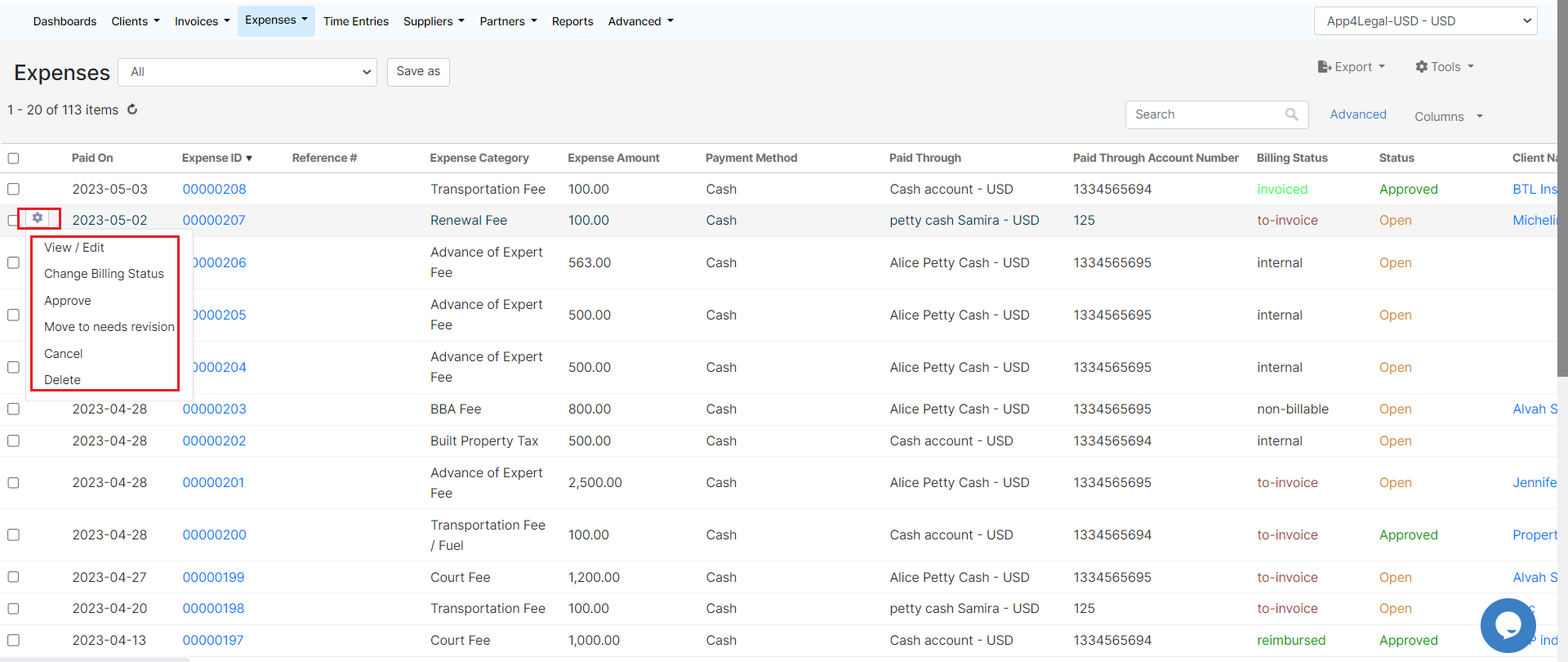

All the expenses will be then listed in the Expense Grid, simply access it from Billing→ Expenses→ List Expenses from the navigation menuAdditional information could be the Tax, Reference number, supplier, comments or any related documents that could be attached as well.

The expenses grid is where you can track and manage all the Expenses recorded, Advance your search, get reports, add bulk expenses, and so on.

| Anchor | ||||

|---|---|---|---|---|

|

All the expenses added can be viewed in the list along with their details, such as amount, status, related client account, and so on.

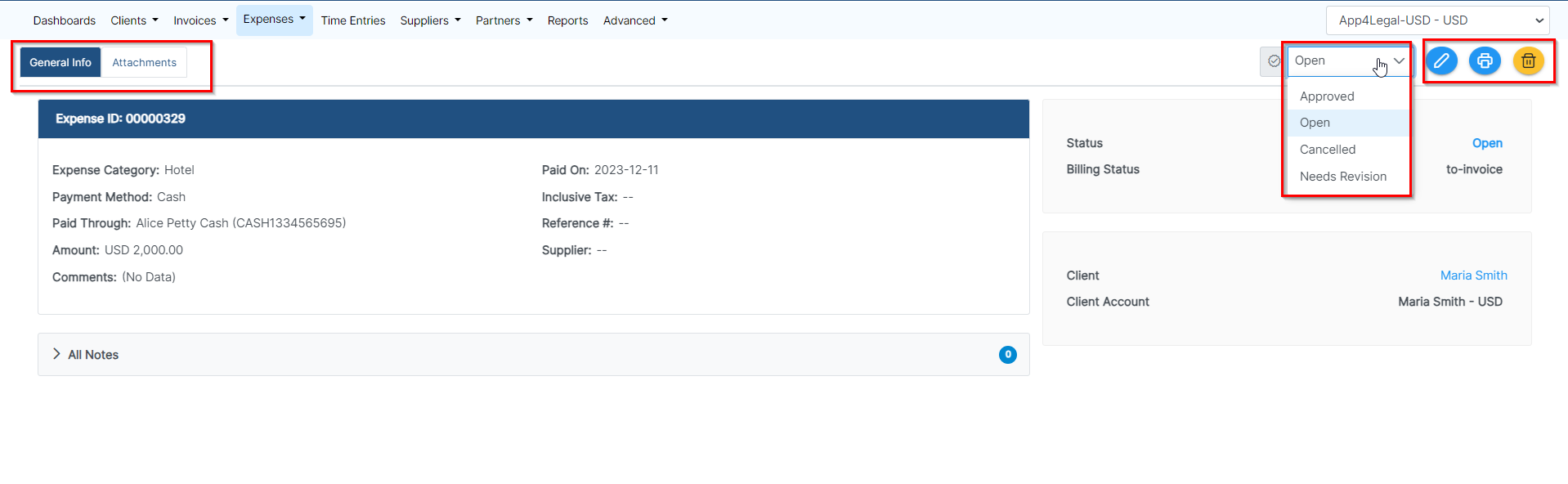

There are certain actions a user can do from the settings wheel next to an expense (view/edit, change billing status, etc.).

The admin can set an approval process. Therefore, responsible users such as accountants, can edit the expense information, approve, review, or cancel an expense before being invoiced.

| Warning |

|---|

Invoiced and Reimbursed expenses can not be edited or deleted. |

...